Home » Digital vs. Traditional Banking: Exploring Financial Process Automation Benefits

Automation is quickly becoming a major driver of growth in the finance sector. The way it manages rising transaction volumes, complex compliance needs, and other critical processes has caught the attention of many financial institutions.

Today, almost every bank uses some level of automation to handle its operations. With modern tools like Robotic Process Automation (RPA) and Artificial Intelligence (AI), banks are now able to serve faster, smarter, and more efficiently. However, the impact of automation varies greatly depending on the environment in which a bank operates.

In this blog, we explore how automation works in Digital vs. Traditional Banking institutions—highlighting performance gaps, technology foundations, and long-term advantages in the journey toward digital transformation.

Financial process automation has transformed several operations within the finance sector. With faster and smarter workflows, it helps both legacy financial institutions and digital-native banks to deliver futuristic financial services. Here’s how automation works in different banking models.

Digital-only banks are operated with modern, cloud-based infrastructure to offer agile and easily accessible financial services. It allows smooth integration of automation across key finance models, including mobile banking, core banking systems, and more.

Digital banks use automation to improve customer experience with faster onboarding, KYC verification, loan processing, fraud detection, and more.

Examples of digital banks include: Neobanks like Chime, Revolut, and Challenger Banks such as Monzo or Starling Bank.

Traditional banks often use outdated legacy architecture, which creates challenges during the adoption of automation. However, with strategic upgrades, automation can still be integrated into several critical areas.

Old-age banks use automation tools like RPA and workflow automation to improve high-volume, repetitive processes.

Examples of traditional banks using automation include: Bank of America, Wells Fargo, and HSBC.

Get free Consultation and let us know your project idea to turn into an amazing digital product.

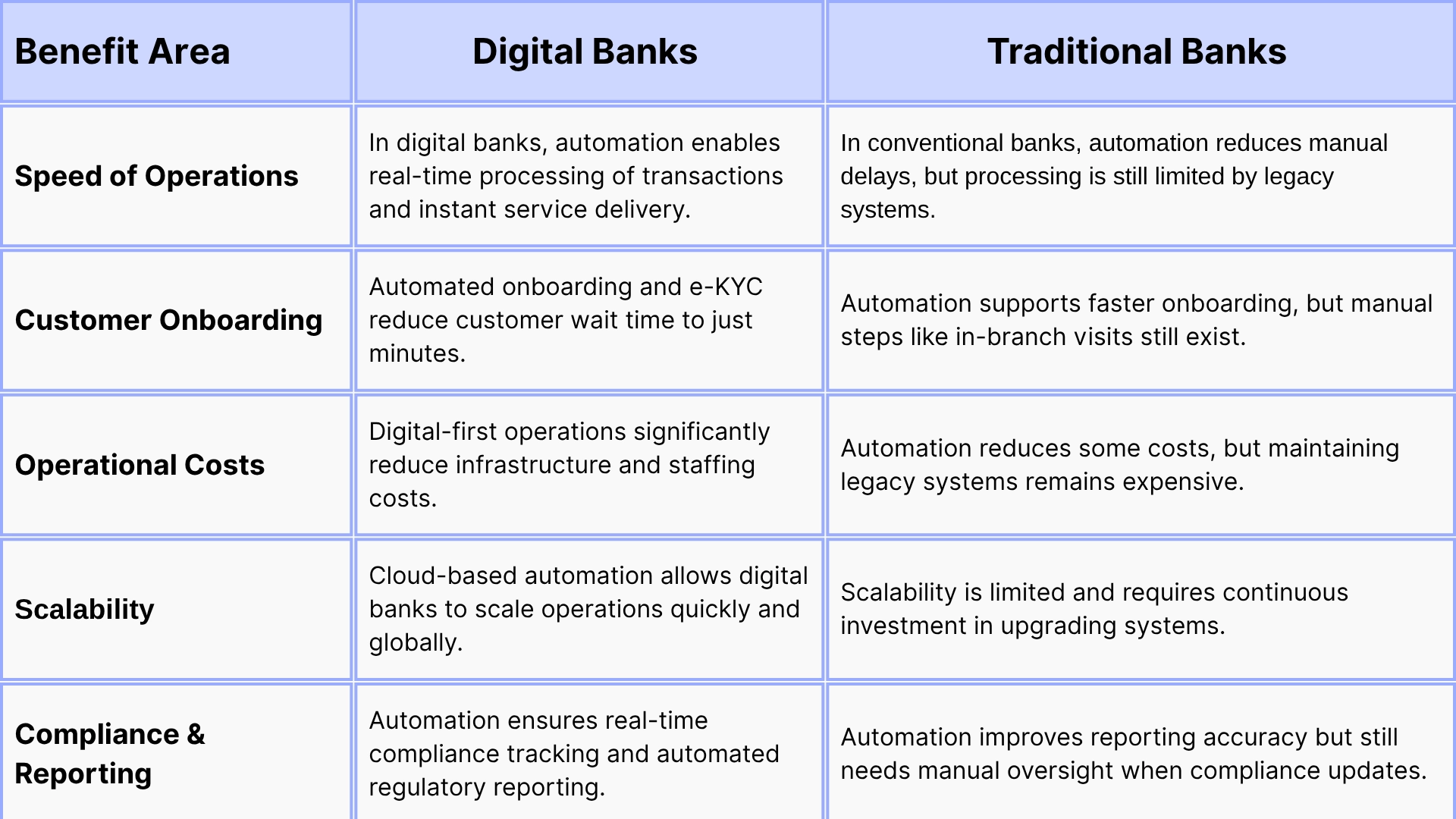

Using automation marks a digital transformation in both banking models; however, its application and impact vary significantly. The table below highlights the differences in automation benefits between digital vs traditional banks.

From credit unions to fintech startups, automation optimizes processes for financial institutions of all sizes. Key technologies that drive digitization in banking operations include:

This technology is known for automating routine task handling that is often repetitive, and rule based. Using Robotic Process Automation (RPA) in banking improves speed and accuracy in document handling, compliance checks, and customer service support.

AI-powered automation is used for performing tasks that require human-like intelligence and machine-like workflow. Banks use these technologies to enable predictive analytics and personalized, data-backed insights.

Integrating APIs into critical areas opens wider opportunities for open banking institutions. It enables real-time data exchange between banks and third-party platforms, allowing secure and fast access to services like payments, account aggregation, and lending tools.

Modernizing core systems with cloud infrastructure bring agility to banking operations. They allow easy deployment of automation solutions to handle updates, process data in real-time, and scale services without disruptions.

Automation eases banking; however, it can be difficult to implement when institutions use outdated systems. Here are some challenges that traditional banks often face with financial process automation.

Share your project idea with us. Together, we’ll transform your vision into an exceptional digital product!

Financial process automation drives positive outcomes in both digital as well as traditional banking models. While traditional banks face challenges due to legacy systems, digital banks benefit more from automation due to their modern infrastructure, faster workflows, and better use of tools like AI and RPA.

In this whole Digital vs. Traditional Banking Debate, Financial institutions must choose the right approach to automation to ensure success in their operations. Whether it’s upgrading legacy systems or building digital-first solutions, automation is no longer optional—it’s essential for staying competitive and meeting growing customer expectations.

Digital banks operate entirely online without physical branches, offering 24/7 access through mobile apps and websites. Traditional banks have physical locations and combine in-person services with digital offerings, providing face-to-face interactions and comprehensive banking relationships.

Yes, digital banks are equally safe. They use advanced security measures like encryption, two-factor authentication, and real-time fraud monitoring, often with more sophisticated cybersecurity than traditional banks.

RPA uses software bots to perform rule-based, repetitive tasks like data entry, document processing, and compliance reporting. These digital workers can operate 24/7, processing transactions faster than humans while maintaining accuracy and reducing operational costs substantially.

Traditional banks face challenges due to legacy system constraints, high upgrade costs, talent gaps in digital skills, risk-averse compliance culture, and complex integration requirements. Their outdated infrastructure makes automation adoption slower and more expensive than digital banks.

Yes, digital banks typically process personal loans much faster due to automated underwriting, AI-driven credit scoring, and streamlined digital documentation. Many digital banks can approve loans within minutes or hours compared to days or weeks with traditional banks.

Neobanks are entirely digital-only banks built from scratch with modern technology, while traditional online banking refers to digital services offered by established banks with physical branches. Neobanks typically offer more innovative features and lower fees.

Banks can save 25-50% on operational costs through automation by reducing manual labour, minimizing errors, accelerating processing times, improving compliance efficiency, and optimizing resource allocation. Digital banks achieve even greater savings due to their automation-first approach.

Digital banks typically allow account opening within 5-15 minutes using automated onboarding and e-KYC verification. Some can approve accounts instantly, while traditional banks may require days or weeks due to manual processes and documentation requirements.

Customer onboarding, loan underwriting, fraud detection, compliance reporting, transaction monitoring, account reconciliation, customer support, and payment processing benefit most from automation. These processes involve high volumes of repetitive, rule-based tasks perfect for automation.

Automation eliminates routine manual jobs but creates new roles in technology, data analysis, and customer relationship management. Banks typically retrain employees for higher-value tasks rather than reducing workforce, focusing human talent on complex problem-solving and relationship building.

Have a one on one discussion with our Expert Panel

Secure access is vital for organizations managing digital identities in today’s landscape. While both CIAM and IAM secure user identities, they serve different purposes — CIAM for customers and IAM for employees. This article explores their key differences and how to choose the right system.

For decades, traditional banking systems handled only basic transactions. The digital era exposed their limitations in speed and adaptability. Evolved core banking now powers seamless, future-ready financial services.

As digital expectations grow, customers now demand speed, ease of use, and 24/7 availability. To meet these demands at scale, digital-only banks choose business process automation in the banking industry to deliver consistent, responsive, and personalized service.

Founder and CEO

Chief Sales Officer