Home » How Neobanks and Fintech Startups Are Winning with Automation

Banking today is not limited to traditional brick-and-mortar branches. The evolution of the finance sector has introduced digital-first and fully digital banks, now referred to as fintechs and neobanks.

These tech-led financial institutions are outpacing conventionally operated banks with fast and easily accessible services. One of their most powerful technologies is banking process automation.

From onboarding a customer to delivering essential banking services, automation is becoming the driving force behind the success of these organizations.

In this blog, we’ll explore how neobanking and fintech leaders are gaining a financial edge with automation—and the impact it creates compared to traditional financial branches.

What Makes Neobanks and Digital Banks Different?

The terms neobank and digital bank are often confused and may sound similar, but they differ in many ways:

A neobank is a cloud-native financial institution. It doesn’t rely on traditional banking infrastructure. It’s built entirely on modern, API-first, scalable systems. Most neobanks don’t have a banking license of their own—they often partner with licensed banks to offer services. Their operations are entirely digital and mobile-focused.

On the other hand, a digital bank is usually an extension of a traditional bank. It operates under the bank’s license but offers services digitally. While it may have an online-first interface, its backend is often tied to legacy core banking systems. This means limited agility compared to neobanks.

Whether it’s a neobank, traditional bank, or fintech, automation is a key factor in enabling agile, data-driven, and customer-focused banking. It completes tasks and delivers services in real time without requiring human involvement. Here’s how technologically advanced banks use automation:

AI-powered automation helps neobanks in working faster and smarter. It enables them to scale faster than legacy-backed digital banks and outperform them in efficiency.

Automated KYC processes for onboarding

Neobanks use AI-driven, automated KYC processes to reduce onboarding time significantly. With this practice, fully digital banks onboard customers in minutes within a secure and scalable space.

AI chatbots for 24×7 customer support

Automation in neobank customer support with AI chatbots ensures real-time responses and faster resolutions. Top neobanks use NLP-powered bots to reduce support costs while boosting customer satisfaction.

Credit decision automation using predictive analytics

Neobanks use predictive AI models to evaluate credit risk in seconds. This credit decision automation helps them offer instant approvals while minimizing defaults.

RegTech integration for real-time compliance

Neobanks automate compliance checks using RegTech tools for regulatory adherence. They continuously monitor transactions and other activities to flag issues in real time and stay audit ready.

Fintech startups use automation technology to ensure smoother operations. It helps them simplify complex banking tasks and improve overall efficiency.

Robotic Process Automation (RPA) for Back-Office Tasks

Fintech startups use RPA solutions to automate repetitive back-office operations, like data entry, reconciliation, and transaction processing. Its main purpose is to reduce manual workload and speed up operations.

AI and Machine Learning for Risk Scoring

Fintech organizations deploy AI/ML models to assess credit risk and detect fraud patterns in real time. It helps them make smarter decisions and mitigate risks proactively.

Intelligent Workflows for Loan Approvals and Credit Checks

Automated workflows also streamline loan approvals and credit checks. It enables fintech startups to process applications faster while maintaining accuracy and compliance with regulations.

Get free Consultation and let us know your project idea to turn into an amazing digital product.

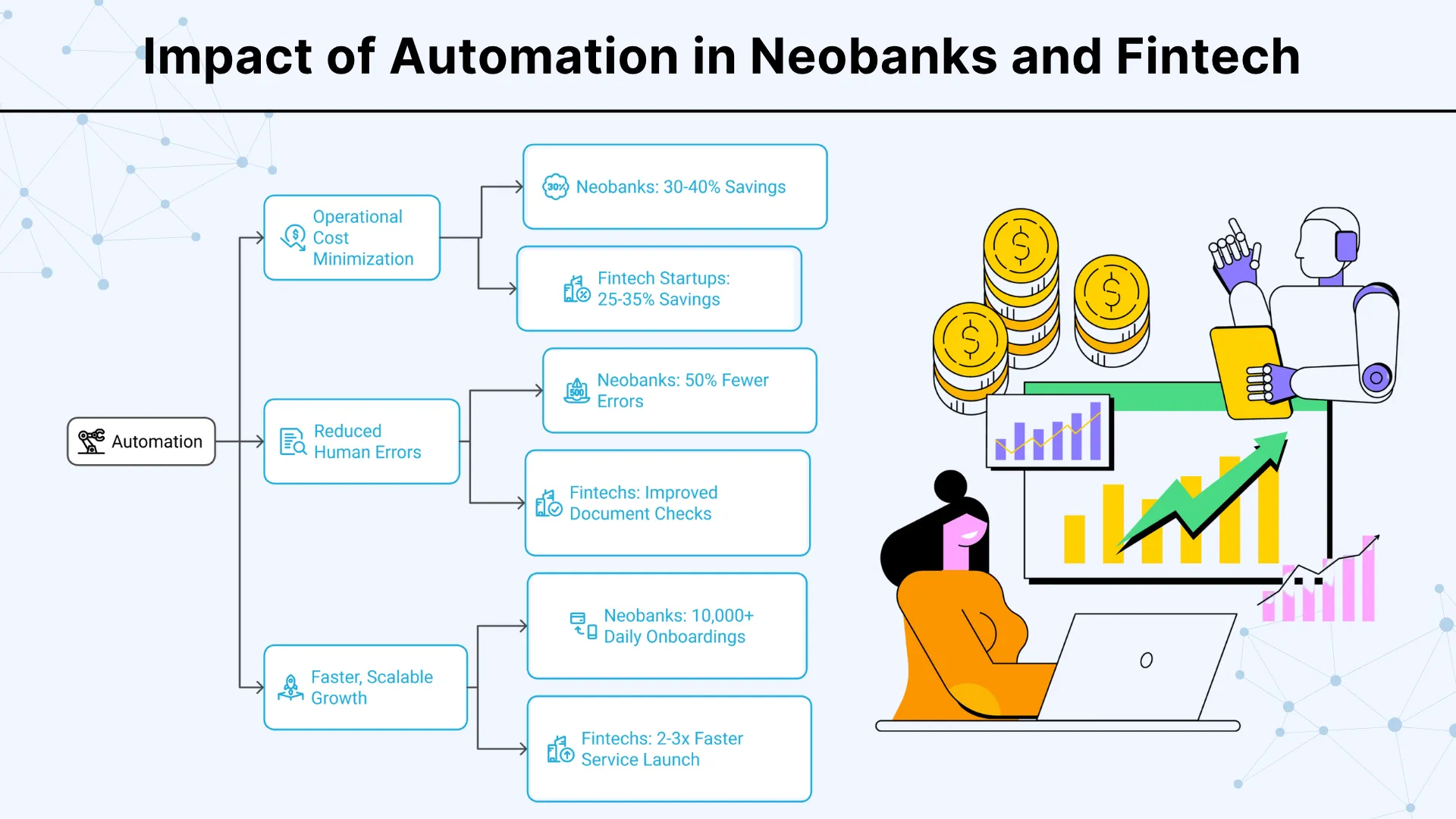

Automation is a key performance enhancer for both neobanks and fintech startups. It provides similar types of workflow benefits but at different scales.

Operational Cost Minimization

Reduced Human Errors

Faster, Scalable Growth

Some of the leading neo banks and digital banking companies have used automation to transform banking processes, reduce costs, and improve customer experience. Here are a few real-world scenarios:

Case Study 1: Revolut’s Use of Automation to Deliver Best Digital Banking Solutions

Revolut, one of the best neo banks, employs automated KYC and AI chatbots to speed onboarding and enhance customer support on its neo bank platform.

Results Achieved:

Case Study 2: N26’s Use of AI to Enhance Customer Satisfaction and Reduce Risk

N26, a fully digital bank, integrates AI-driven credit decision automation and real-time compliance checks to minimize NPAs and deliver smooth banking experiences.

Results Achieved:

Case Study 3: Chime’s Digital-First Approach Boosts Workflow Efficiency

Chime leverages cloud digital banking solutions and robotic process automation for back-office efficiency, reducing manual errors and speeding transactions.

Results Achieved:

Share your project idea with us. Together, we’ll transform your vision into an exceptional digital product!

Automation is the main reason why there is a rapid innovation and scaling happening in neobanks and fintech startups. It streamlines processes and makes customer experiences better, helping them grow faster than traditional banks.

To stay competitive, many traditional banks are also modernizing their operations by embracing automation-driven strategies. The shift to automation and cloud-based solutions is now essential for improving efficiency, reducing errors, and meeting evolving customer expectations.

Neobanks are cloud-native financial institutions without physical branches, while digital banks are online extensions of traditional banks with legacy systems.

Yes, neobanks partner with licensed banks and use advanced security measures, though they may not hold full banking licenses themselves.

Robotic Process Automation (RPA) automatically handles repetitive tasks like data entry, reconciliation, and transaction processing in banking operations.

Fintech startups use automation for customer onboarding, compliance monitoring, risk assessment, and back-office operations to scale efficiently.

Generally, yes—digital banks depend on legacy systems, which limit agility compared to neobanks built on flexible API platforms.

RegTech automates regulatory compliance processes, continuously monitors transactions, and helps neobanks stay audit-ready and compliant with regulations.

Most neobanks offer account opening in minutes through automated KYC processes, compared to days or weeks with traditional banks.

Predictive analytics assess credit risk in seconds, enabling faster loan approvals and reducing default rates.

Automation uses AI chatbots to handle routine queries instantly, freeing human agents for complex issues and improving service quality.

Yes, automation drives faster services, cost efficiency, better compliance, and superior customer experiences, essential for future banking success.

Have a one on one discussion with our Expert Panel

This is one of the most common questions beginners ask when they start learning Microsoft Power BI. Many users install Power BI Desktop, hear about dashboards, then suddenly come across something called Power BI report builder and feel stuck.

Recent industry data shows that most enterprises now treat Azure Migration Services as a core part of their IT modernization plans rather than a one time project. Businesses are actively prioritizing cloud migration to Azure to improve reliability, security, and long term cost control.

In the past, business intelligence tools focused on collecting data and creating reports every month. That approach worked when things moved slowly. Now, businesses need to make decisions in seconds. Waiting for static reports can mean missing sales, reacting late to supply issues, or not spotting financial risks on time.

Founder and CEO

Chief Sales Officer