Home » Hyperautomation and Generative AI: What’s Next for Financial Services?

Banking automation has significantly advanced in recent years. From rule-based systems to intelligent and adaptive solutions, every upgrade has been released to improve efficiency, accuracy, and regulatory compliance.

With rising volumes of data, growing compliance demands, and the need for faster decision-making, timely technological change has become essential.

Hyperautomation and Generative AI are now two of the most talked-about topics in banking automation. Banks are increasingly adopting these technologies to enable seamless, end-to-end operations across financial services.

In this article, we will explore how Hyperautomation and Generative AI are shaping the future of finance. Moreover, we will highlight key insights to help institutions understand their full potential with automation in financial services.

The introduction of automation in financial services or automation tools in financial institutions was focused to reduce manual effort and manage rising operational demands. In its initial stages, automation focused on rule-based, repetitive processes. Over time, it evolved into more intelligent systems capable of handling data-driven tasks.

Use cases of intelligent automation in banking include: Fraud detection, customer behaviour analysis, and automated loan assessments.

Key Point: Hyperautomation and Generative AI are the most advanced forms of intelligent automation, focused on creating intelligent, end-to-end workflows that go beyond routine tasks.

Get free Consultation and let us know your project idea to turn into an amazing digital product.

Using hyperautomation for delivering financial services provides several benefits, including:

Using hyperautomation for delivering financial services provides several benefits, including:

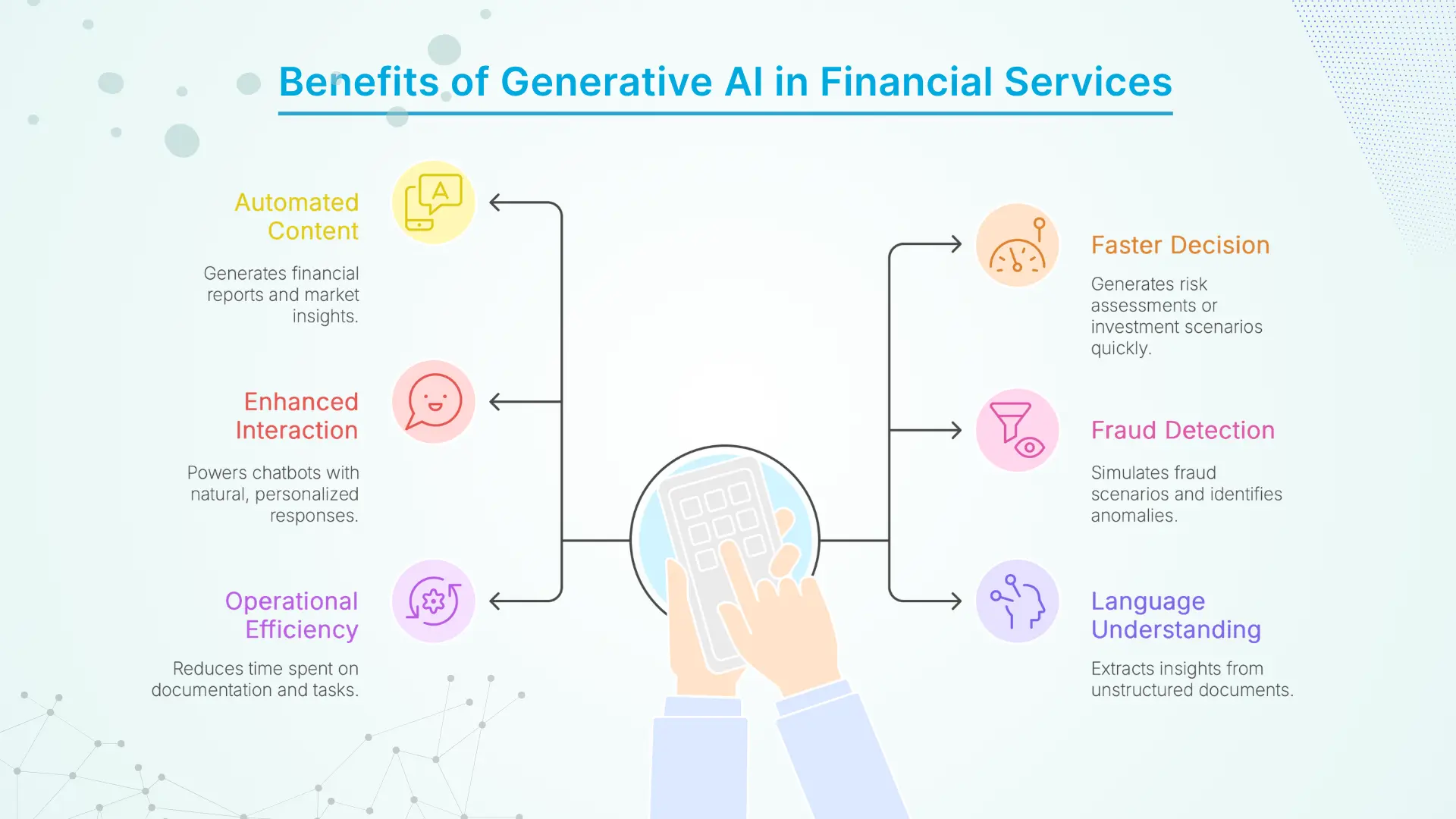

AI-driven automation solutions ease processes by adding human-like intelligence in financial workflows. Here are its core benefits:

AI-driven automation solutions ease processes by adding human-like intelligence in financial workflows. Here are its core benefits:

Share your project idea with us. Together, we’ll transform your vision into an exceptional digital product!

Now comes the key question: Which technology delivers better returns for financial institutions?

While both AI and Hyperautomation drive efficiency and innovation in the workflows, their strengths vary in different areas. Below is a comparison to help understand where each delivers the most value.

While rising customer expectations and stricter regulatory requirements are increasing complexity in banking, automation continues to simplify it. With optimized workflows and accelerated decision-making, it allows institutions to meet evolving demands efficiently via automation in financial services.

However, traditional rule-based automation for banking is no longer sufficient. Increasing data volumes, real-time processing needs, and compliance pressures demand advanced, context-aware solutions.

As a result, banks are adopting Hyperautomation and Generative AI to implement intelligent, end-to-end automation. These technologies are known for enhancing process efficiency even at scale.

AI provides intelligence while hyperautomation enables business process automation in banking industry. Combined, they enable agile, data-driven banking ready for future demands.

Traditional RPA automates specific repetitive tasks using rule-based logic, while hyperautomation integrates AI, machine learning, and analytics to create intelligent, scalable automation across complete business processes.

AI in banking enables fraud detection, personalized customer service, automated decision-making, risk assessment, compliance monitoring, and improved operational efficiency while reducing manual errors and costs.

KYC verification, loan processing, compliance reporting, customer onboarding, fraud detection, transaction monitoring, and regulatory reporting are ideal candidates for hyperautomation due to their complexity.

Banks typically see 20-40% cost reduction, 60-80% faster processing times, improved accuracy, and enhanced compliance. Long-term ROI includes scalability and continuous operational transformation benefits.

Key challenges include data quality issues, legacy system integration, regulatory compliance, high implementation costs, employee resistance, security concerns, and the need for specialized technical expertise.

Generative AI automates report generation, creates risk models, drafts client communications, analyses market data, generates investment scenarios, and assists with regulatory documentation and compliance reporting.

Yes, when properly implemented with encryption, access controls, audit trails, and compliance frameworks. However, banks must ensure robust cybersecurity measures and regular security assessments are maintained.

Implementation takes several months depending on complexity, system integration requirements, data readiness, regulatory approvals, and the scope of processes being automated across the organization.

Employees need data analysis skills, process design knowledge, AI tool familiarity, change management capabilities, and understanding of compliance requirements to effectively work with automated systems.

Yes, with cloud-based solutions, SaaS platforms, and phased implementation approaches, smaller banks can access hyperautomation tools cost-effectively while scaling according to their specific needs and budgets.

Have a one on one discussion with our Expert Panel

When it comes to data visualization tools, organizations face a decision that affects how teams interpret data, share insights, and respond to business shifts. Microsoft Power BI and Tableau Software dominate enterprise analytics, yet they serve different operational needs.

This is one of the most common questions beginners ask when they start learning Microsoft Power BI. Many users install Power BI Desktop, hear about dashboards, then suddenly come across something called Power BI report builder and feel stuck.

In the past, business intelligence tools focused on collecting data and creating reports every month. That approach worked when things moved slowly. Now, businesses need to make decisions in seconds. Waiting for static reports can mean missing sales, reacting late to supply issues, or not spotting financial risks on time.

Founder and CEO

Chief Sales Officer