Home » Automating KYC and AML: Ensuring Compliance and Speed in Digital Banking

Digital banking has brought significant changes to financial institutions, allowing customers to access faster, more convenient services with ease. However, this shift has also shaken banks, as compliance standards, especially KYC (Know Your Customer) and AML (Anti-Money Laundering) have become stricter and more difficult to manage.

Manual compliance processes are no longer effective as they often lead to delays, errors, and higher operational costs. With the digitization of banks, modernizing compliance is equally critical.

By leveraging technologies like AI, machine learning, and robotic process automation, banks can streamline compliance processes and adapt to evolving regulations. This blog explores how automated KYC/AML solutions help reduce compliance burdens and improve operational accuracy.

With more and more banks shifting from traditional to online banking, regulatory standards are becoming more stringent and data intensive.

Regulators now demand advanced data security, real-time monitoring, enhanced due diligence, and dynamic risk assessment to stay ahead of fraud and cyberthreats. This results in greater operational complexity and rising compliance costs.

Relying on manual processes to manage compliance can expose banks to serious financial and reputational risks. Adopting digital AML and KYC automation tools is a strategic move to streamline compliance, reduce costs, and accelerate response times.

KYC (Know Your Customer) and AML (Anti-Money Laundering) are two essential compliance processes in banking. KYC focuses on verifying customer identities and assessing risk, while AML aims to detect and prevent fraudulent or suspicious financial activities.

The functioning of both these processes relies heavily on data collection, pattern recognition, and compliance checks, which automation performs exceptionally well.

Rule-based engines can instantly validate identity documents, screen against watchlists, and trigger risk-based workflows. AI further enhances automation by detecting anomalies and predicting fraud with high accuracy.

Choosing automated KYC/AML solutions over manual processes eliminates slow, error-prone workflows and meets the challenging regulatory demands like real-time monitoring, enhanced due diligence, and more.

Get free Consultation and let us know your project idea to turn into an amazing digital product.

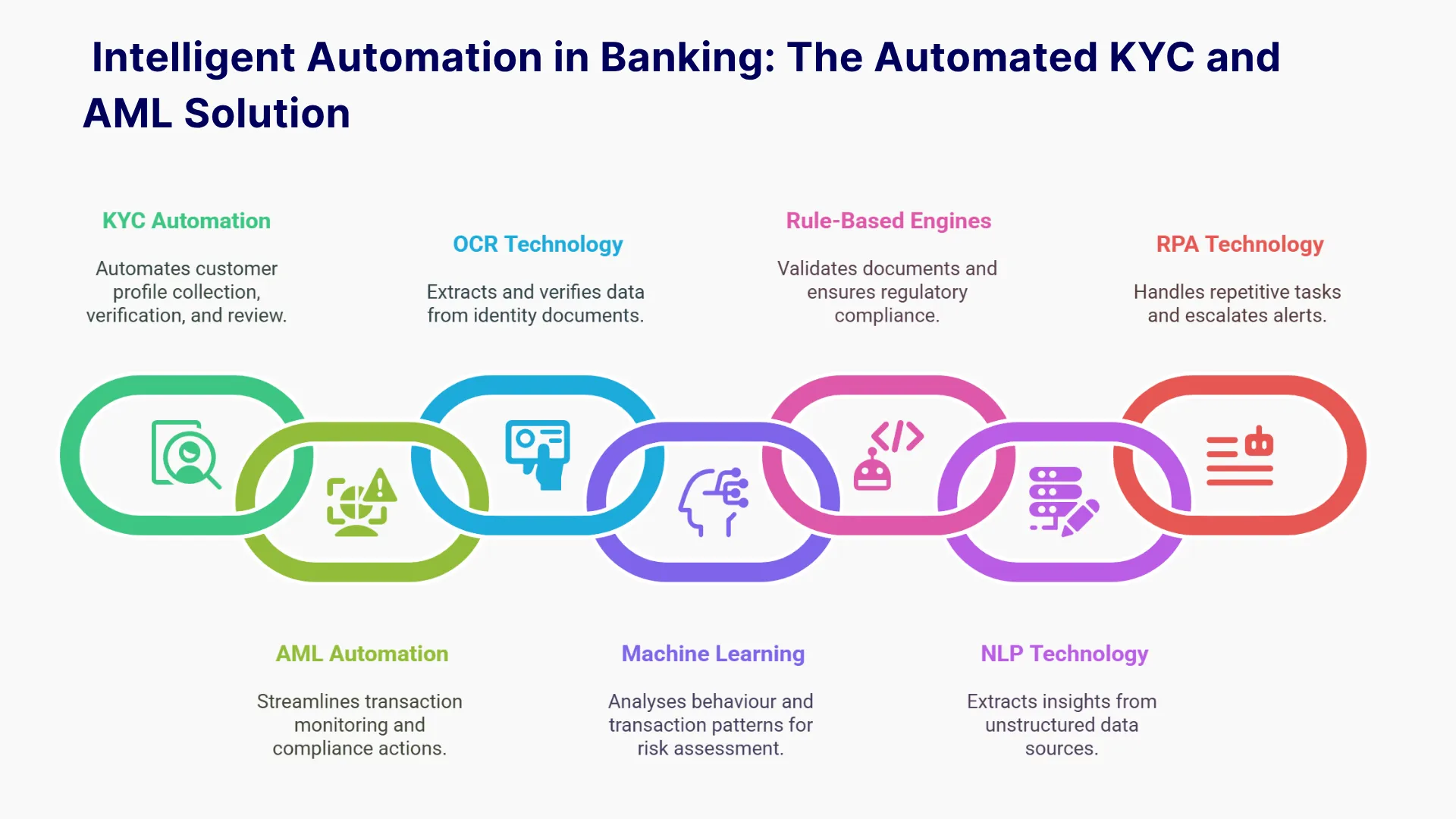

IA automates the entire KYC lifecycle; which means it collects, verifies, and reviews customer profiles at scale without the need for manual intervention. Several technologies work together to streamline KYC processes for banks:

Automated KYC checks significantly reduce customer onboarding time, identify high-risk profiles early, and maintain full compliance.

Intelligent Automation streamlines AML processes by continuously monitoring transactions, detecting suspicious activity, and automating compliance actions. A combination of advanced technologies supports these efforts in real time:

A digital AML approach reduces the burden on compliance teams, accelerate response times, and improve overall risk management.

Automated KYC and AML software eliminates manual tasks and enhances overall operational efficiency within financial institutions. These solutions offer several key benefits, including:

Share your project idea with us. Together, we’ll transform your vision into an exceptional digital product!

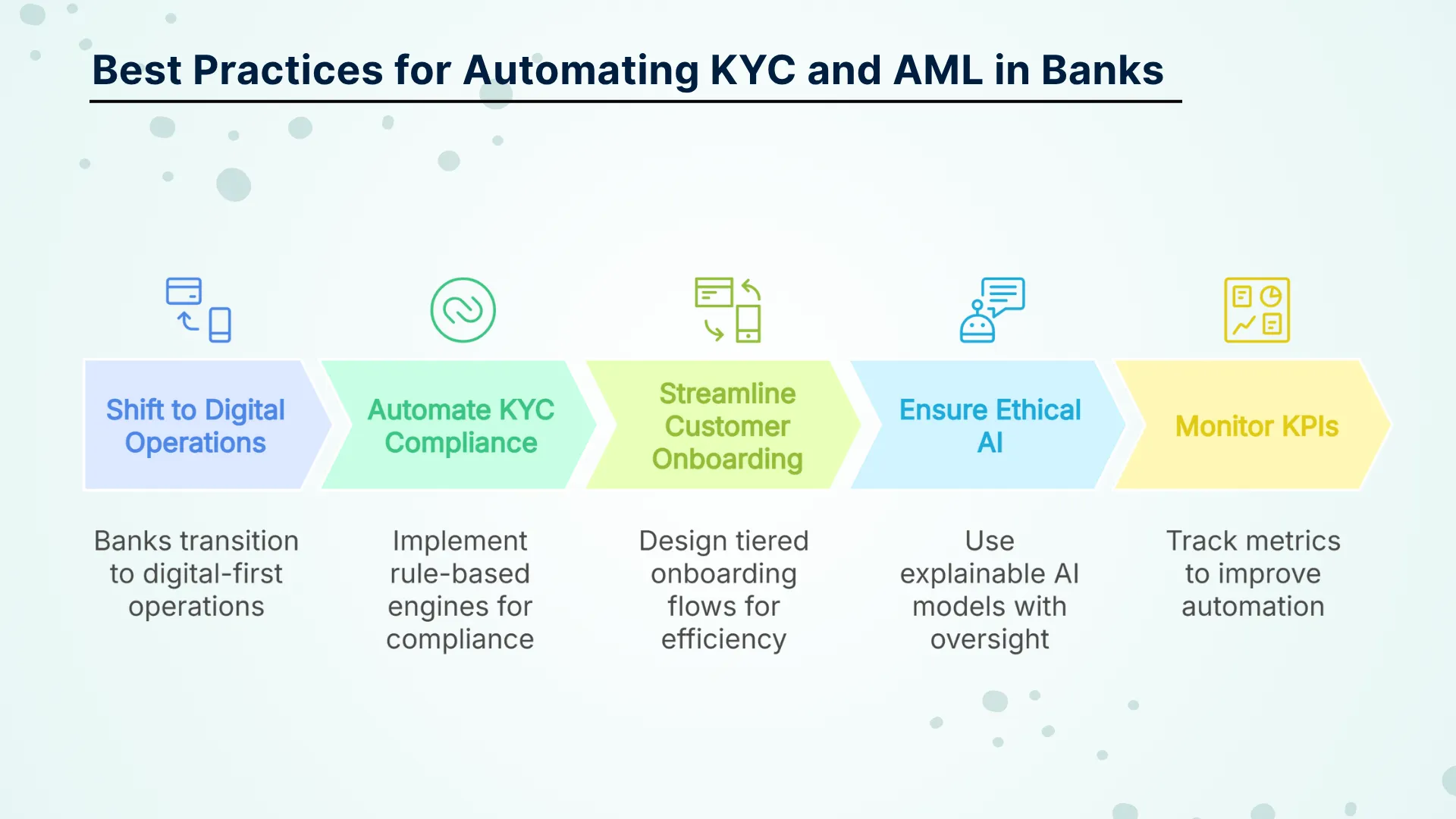

1. Automate KYC Compliance with Audit Readiness in Mind

Build compliance into your systems from day one. Use rule-based engines to enforce regulatory logic, securely store verification logs, and align workflows with region-specific KYC rules. Ensure audit trails are complete, unalterable, and easy to retrieve for reporting.

2. Streamline Customer Onboarding with Smart Workflows

Design tiered onboarding flows based on risk levels. Automate low-risk approvals using set criteria, while routing high-risk cases to manual review. Integrate real-time identity verification APIs to speed up onboarding without compromising compliance.

3. Ensure Ethical AI and Transparent Decision-Making

AI models used for risk scoring or anomaly detection must be explainable. Use models with traceability and review mechanisms. Maintain human oversight for critical decisions and keep clear documentation for audits and regulatory checks.

4. Monitor Key Performance Indicators (KPIs)

Track performance to continuously improve automation. Key metrics include:

Using AI-powered KYC and AML compliance solutions in fintech banks ensures speed, consistency, and accuracy across complex financial workflows. With streamlined customer onboarding and enhanced fraud detection, digital banks can operate within a secure, customer-centric, and fully compliant ecosystem.

Implementing intelligent automation in banking is no longer optional — it is essential for staying competitive, reducing risk, and meeting growing regulatory demands.

AML automation reduces false positives, accelerates transaction monitoring, improves risk assessment accuracy, ensures consistent compliance, reduces operational costs, and enables real-time suspicious activity detection while maintaining comprehensive audit trails for regulatory reporting.

Machine learning analyses customer behaviour patterns, transaction histories, and risk indicators to improve identity verification accuracy, reduce false positives, predict potential fraud, and continuously learn from new data to enhance decision-making capabilities over time.

Enhanced due diligence automatically triggers additional verification steps for high-risk customers, including source of funds verification, political exposure screening, adverse media checks, and comprehensive background investigations using advanced analytics and external data sources.

OCR analyses customer documents, extracting text for automated verification and validation, minimizing manual data entry errors and speeding up document processing.

Yes, cloud-based automation solutions offer scalable pricing models that make KYC/AML automation accessible to smaller banks. Many vendors provide tiered pricing, SaaS models, and gradual implementation options that fit different budget constraints and institutional sizes.

Automated KYC systems require continuous updates to maintain effectiveness. Regulatory changes, watchlist updates, and algorithm improvements should be implemented monthly or quarterly, while security patches and system maintenance may be required more frequently.

Automation, especially through machine learning models like graph-based and continual learning systems, can significantly reduce false positives—by up to 80%—by accurately filtering out irrelevant or low-risk alerts.

Advanced automated systems use configurable rule engines that adapt to different regional regulations, maintain updated watchlists, apply jurisdiction-specific requirements, and ensure compliance with local laws like GDPR, BSA, and other international regulatory

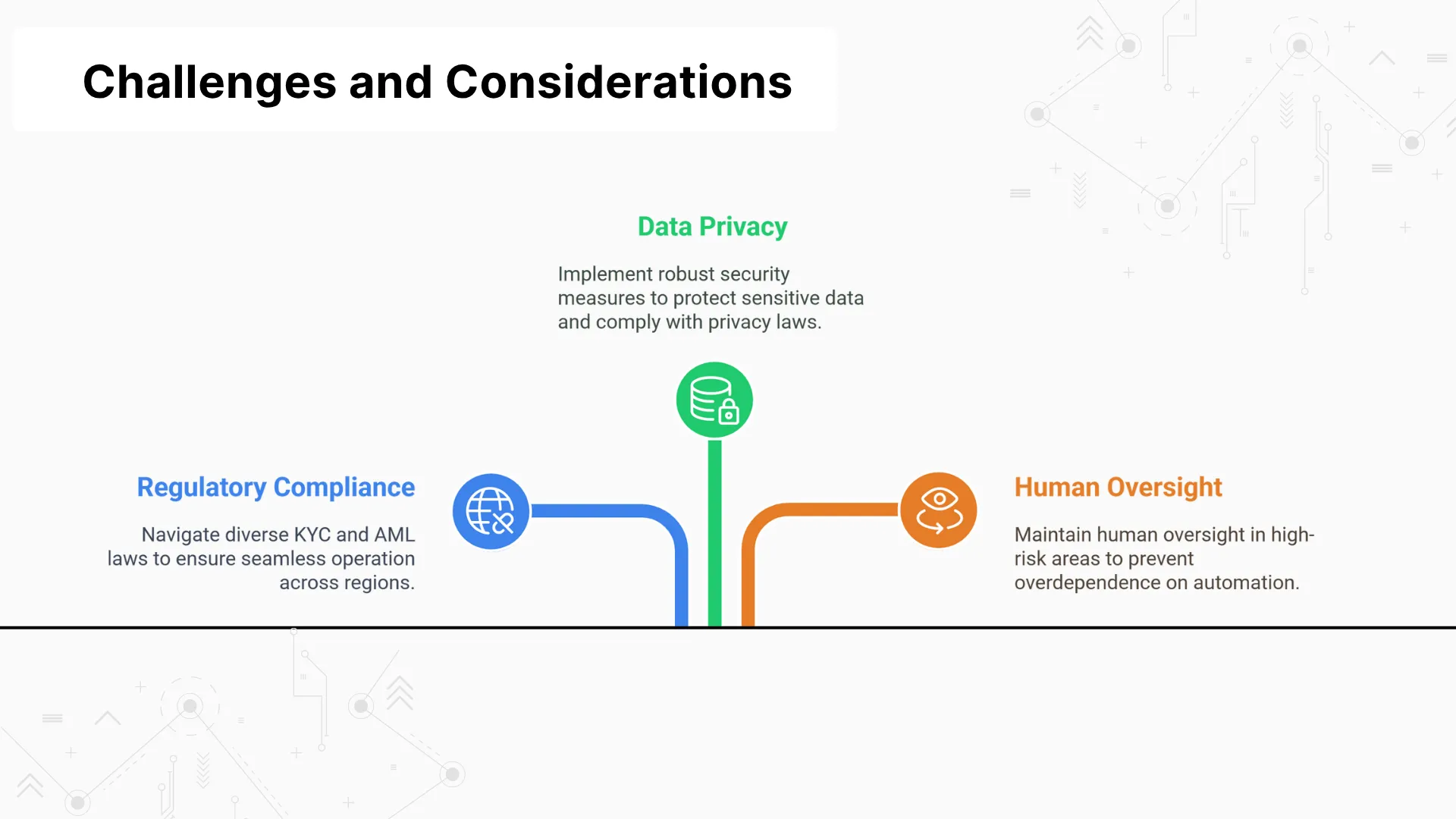

Key challenges include regulatory fragmentation across regions, data integration complexities, ensuring data privacy compliance, managing false positives, maintaining human oversight, initial implementation costs, staff training requirements, and adapting to evolving regulatory requirements.

Automated systems maintain complete digital audit trails, generate comprehensive compliance reports, store verification logs securely, document all decision processes, ensure data integrity, and provide easy access to historical records for regulatory examinations and reporting requirements.

Have a one on one discussion with our Expert Panel

Most enterprises did not choose to be here. Core systems were built to be stable, not adaptable. Over time, layers of customization, integrations, and workarounds turned reliability into rigidity. Today, every new digital initiative feels harder than it should be.

Recent industry data shows that most enterprises now treat Azure Migration Services as a core part of their IT modernization plans rather than a one time project. Businesses are actively prioritizing cloud migration to Azure to improve reliability, security, and long term cost control.

In 2026, moving workloads to Azure cloud migration is not just about transferring data. It’s about making the whole process smarter, more automatic, and easier to manage while keeping compliance and security tight.

Founder and CEO

Chief Sales Officer