Home » Payment Processing Automation: Reducing Errors and Accelerating Settlements

In banking operations, reducing errors and accelerating settlements is a top priority. However, many banks still fail to achieve this.

Processing payments involves multiple steps, such as verifying account details, checking records, and ensuring timely execution. In the current financial environment, manual approaches slow down these processes and increase the risk of errors.

Payment processing automation is becoming a strong replacement for manual workflows, as it addresses these challenges with intelligent, system-driven operations.

As automation adoption grows across banking, this area is becoming critical to meeting the demands of scalability, rising customer expectations, and strict compliance requirements.

Payment process automation refers to using a software system to automatically manage, execute (sending or receiving), and track financial transactions. Unlike traditional processes that take days to complete, an automated solution verifies, initiates, and records transactions within minutes.

These automated systems integrate with ERP platforms or bank APIs to retrieve data and trigger actions. They support scheduling of payments, invoice validation, approval routing, and real-time ledger updates.

Financial institutions implement payment automation to handle high transaction volumes with accuracy and under compliance standards.

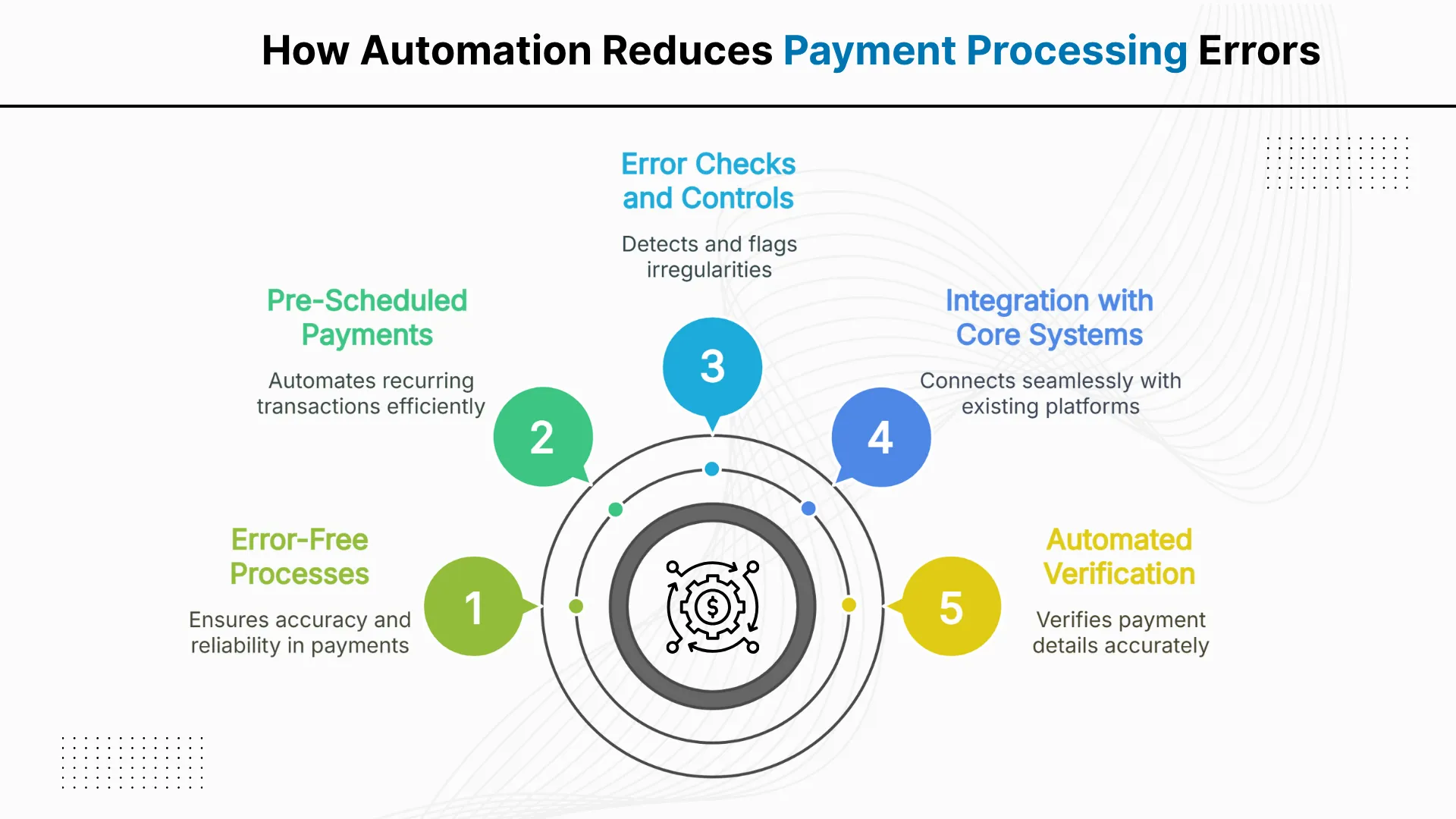

1. Automated Verification of Payment Information- Automated systems cross verify account numbers, payment amounts, and beneficiary details before processing any transaction.

2. Integration with Core Systems- Automated systems connect directly to ERP platforms and bank APIs to remove the need for manual data transfer.

3. Built-in Error Checks and Controls- Automation solutions apply validation rules to detect duplicates, missing fields, and anomalies. The system flags irregularities before approval.

4. Pre-Scheduled and Recurring Payments- Payment automation enables institutions to set up recurring transactions such as payroll or vendor disbursements. The system executes these payments on time without manual intervention.

Get free Consultation and let us know your project idea to turn into an amazing digital product.

Automating payment processes not only reduces financial errors, but it also accelerates settlements. With real-time validation, smart workflows, and integrated systems, it offers several benefits to financial institutions, including:

Automated systems process payments at fixed intervals or in real time using scheduled triggers. This prevents delays, reduces reliance on staff availability, and ensures consistent settlement cycles.

Workflow automation routes payment requests directly to designated approvers. This eliminates manual routing, speeds up decision-making, and maintains policy compliance.

Payment automation syncs transactional data with core financial systems. This enables instant reconciliation and supports real-time reporting without waiting for manual input.

The system updates payment status and ledger entries as transactions occur. Finance teams use this real-time data to monitor liquidity and manage working capital accurately.

Automated payments reach vendors on time, aligned with agreed terms. Timely settlements reduce follow-ups, avoid penalties, and improve vendor relationships.

Automation in payments is no more an exception; several businesses have already transformed their processes through automation. Below are two real-world platforms that demonstrate how payment automation solutions transform settlements:

BluePay, a U.S.-based payment processor, automates credit card, ACH, and mobile transactions. It uses features such as tokenization, fraud detection, and recurring billing to ensure secure and consistent payment flows.

Businesses implement BluePay to minimize manual reconciliation, reduce fraud risk, and accelerate settlement cycles.

Prism bills pay is one of the best tools for automating bill payment settlements. It automates bill payments across more than 11,000 service providers. The platform has processed over $1 billion in payments by offering real-time tracking, payment reminders, and same-day execution.

It helps users avoid missed payments and simplifies monthly bill management through automation.

Automating vendor onboarding optimizes payment processing by removing manual data collection and validation. Instead of handling forms and spreadsheets, automated payment systems securely capture and verify vendor information through digital workflows. Below are the key steps to implement vendor payment automation:

Deploy secure online forums where vendors submit tax information, contact details, and banking credentials. The system captures this data in structured formats for direct use.

Verify vendor identities against government watchlists and perform real-time validation of submitted documents. The system flags mismatches or compliance issues automatically.

Assign payment methods, currencies, transaction limits, and approval flows to each vendor based on predefined business policies. Automation ensures these rules are consistently applied.

Trigger recurring or scheduled transaction automation for approved vendors. The system handles invoice matching, payment execution, and real-time status updates without manual intervention.

Use integrated dashboards to track onboarding progress, compliance checks, and payment exceptions. Set alerts to flag anomalies or changes in vendor risk profiles.

Share your project idea with us. Together, we’ll transform your vision into an exceptional digital product!

Automated payment processing is a way to transform how financial institutions manage vendor payments. By streamlining payment settlements with automation technology, banks reduce manual dependencies, enforce consistency, and transact quickly.

These systems not only improve speed but also contribute to improving accuracy, minimizing risks of duplication, delays, and data errors.

For growing financial institutions, the goal is not just to accelerate payment settlements with automated systems, but to adopt smarter, scalable ways of managing financial operations.

Payment automation uses software systems to automatically manage, execute, and track financial transactions without manual intervention, reducing errors and processing times significantly.

Automated systems eliminate manual data entry mistakes by cross-verifying account numbers, payment amounts, and beneficiary details before processing any transaction through built-in validation rules.

Key benefits include faster settlement times, reduced processing costs, improved accuracy, enhanced cash flow visibility, better vendor relationships, and compliance with regulatory requirements automatically.

Yes, most modern payment automation solutions offer API integrations with popular ERP platforms like SAP, Oracle, QuickBooks, and NetSuite for seamless data synchronization.

Payment automation systems use bank-level encryption, tokenization, multi-factor authentication, and comply with PCI DSS standards to ensure maximum security for all financial transactions.

Modern systems include fail-safes, error alerts, automatic retry mechanisms, and manual override options to handle exceptions while maintaining detailed audit trails for troubleshooting.

Automated systems maintain compliance through built-in regulatory controls, automated reporting, audit trails, anti-money laundering checks, and real-time monitoring of suspicious transaction patterns.

Yes, systems support customizable approval hierarchies, spending limits, multi-level authorizations, and automatic routing based on transaction amounts, vendor types, and company policies established.

Comprehensive dashboards show transaction volumes, processing times, error rates, cost savings, vendor performance metrics, cash flow forecasts, and customizable reports for stakeholders.

Automation improves bank relationships through consistent transaction volumes and reduces vendor inquiries by ensuring timely, accurate payments with transparent tracking and communication.

Have a one on one discussion with our Expert Panel

This is one of the most common questions beginners ask when they start learning Microsoft Power BI. Many users install Power BI Desktop, hear about dashboards, then suddenly come across something called Power BI report builder and feel stuck.

In the past, business intelligence tools focused on collecting data and creating reports every month. That approach worked when things moved slowly. Now, businesses need to make decisions in seconds. Waiting for static reports can mean missing sales, reacting late to supply issues, or not spotting financial risks on time.

As this year closes, no-code automation is steering digital transformation across industries. Businesses that began with low-code tools are now scaling faster through Power platform development strategies. Many are realizing that innovation, security, and efficiency can coexist when automation is built on Microsoft Power platform.

Founder and CEO

Chief Sales Officer