Fraud detection using AI in banking applies advanced algorithms to identify patterns and block suspicious activity in real time. In a financial landscape where online losses continue to evolve, using automated AI-powered fraud detection can protect financial institutions from massive losses.

About us

About us Who We are

Who We are Our Products

Our Products E-books

E-books Contact us

Contact us Skilled Tasker

Skilled Tasker Speedo Delivery

Speedo Delivery Best Match

Best Match Locate Bee

Locate Bee Load Near Me

Load Near Me Hire dotnet Developer

Hire dotnet Developer

Hire Flutter Developer

Hire Flutter Developer

Hire Hybrid Developer

Hire Hybrid Developer

Hire Android Developer

Hire Android Developer

Hire Frontend Developer

Hire Frontend Developer

Hire NodeJS Developer

Hire NodeJS Developer

Hire Xamarin Developer

Hire Xamarin Developer

Hire iOS Developer

Hire iOS Developer

Hire WordPress Developer

Hire WordPress Developer

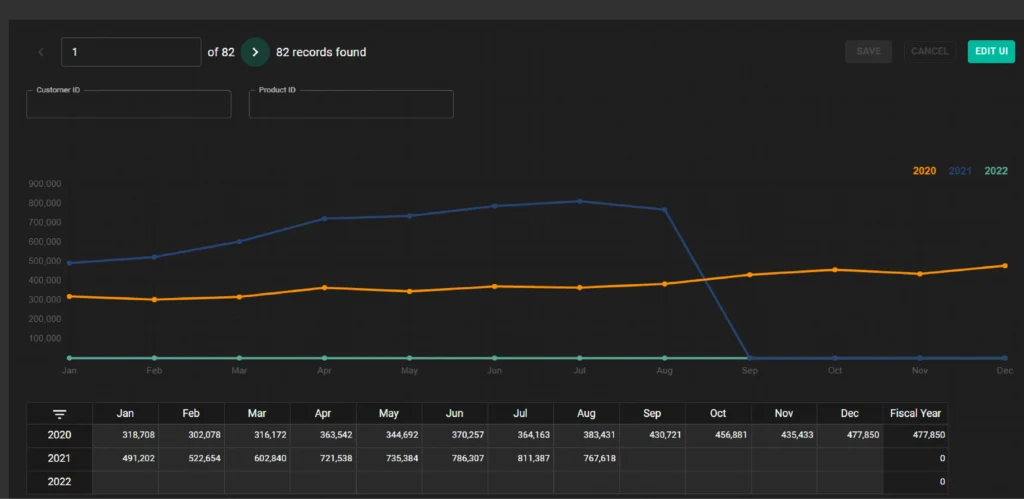

Power BI

Power BI

Power Pages

Power Pages

Copilot Studio

Copilot Studio

Power Automation

Power Automation

Power Apps

Power Apps

Power Virtual Agents

Power Virtual Agents

Developer Tools

Developer Tools

Databases

Databases

DevOps

DevOps

Identity

Identity

Integration

Integration

Management and Governance

Management and Governance

Internet of Things

Internet of Things

Migration

Migration

Mobile

Mobile

Security

Security

Web

Web

Analytics

Analytics

Sales

Sales

Marketing

Marketing

HR

HR

Supply Chain Management

Supply Chain Management

Intelligent Order Management

Intelligent Order Management

Flutter Development

Flutter Development

Ionic Development

Ionic Development

JavaScript

JavaScript

Wearable

Wearable

AR VR

AR VR

MongoDB

MongoDB

Amazon Web Services

Amazon Web Services

MySQL

MySQL

Azure Development

Azure Development

User Experience

User Experience

User Interface and Evaluation

User Interface and Evaluation

User Experience Review

User Experience Review

Digital Marketing

Digital Marketing

Social Media Marketing

Social Media Marketing

PPC

PPC

SEO

SEO

IT consultation services

IT consultation services

Dev Ops

Dev Ops

Launching and Growth Hacking

Launching and Growth Hacking

Scope of Work

Scope of Work

Product Discovery Workshop

Product Discovery Workshop

Strategic Business Analysis

Strategic Business Analysis

Food And Beverage

Food And Beverage

Banking and Financial

Banking and Financial

Travel and Tourism

Travel and Tourism

Oil and Gas

Oil and Gas

Energy and Utility

Energy and Utility

E-commerce

E-commerce

Media and Social

Media and Social

Healthcare

Healthcare

Hospitality

Hospitality

Education

Education

Real Estate

Real Estate

quincy

quincy

Customer Support

Customer Support

Lead Generation

Lead Generation

Appointment Setter

Appointment Setter

E-Commerce

E-Commerce