Home » How Azure Services Can Mitigate Legacy System Migration from Banking in 2024 ?

Banks are facing increasing pressure from fintech disruptors, whose innovations outpace traditional banking systems, hindering banks’ ability to meet modern client demands for fast and convenient transactions. Legacy banking systems, often outdated and monolithic in structure, struggle to adapt to technological advancements and evolving customer needs. To remain competitive, banks must migrate to modular and scalable architectures, necessitating an end-to-end migration strategy. Legacy banking applications suffer from decreased performance, bugs, and errors, failing to meet the demands of the digital age and customer expectations for instant financial services. In this blog we will discuss How Azure database migration services offer solutions to ease legacy system migration in banking.

Legacy banking systems are outdated, mainframe-based platforms supporting core operations like account management and transaction processing. They hinder digital transformation, are costly to maintain, and lack compatibility with modern software solutions like Big Data analytics. However, modernizing these systems is vital for banks to stay competitive, enabling them to adopt digital channels, improve customer experiences, and launch new services efficiently.

Legacy banking systems pose various challenges that impede banks’ progression towards modernization and digital transformation. Let’s explore these obstacles:

Constrained Data Integration and Reporting: Legacy systems often grapple with integrating data and generating comprehensive reports. This deficiency restricts decision-makers from accessing real-time insights crucial for operational efficiency.

Security Vulnerabilities: Safeguarding sensitive customer data becomes increasingly challenging as outdated systems harbor security flaws due to antiquated technology and insufficient security measures.

Manual Processes: Legacy systems heavily rely on manual operations, leading to inefficiencies and inflated operational expenses. The lack of automation limits productivity and slows down overall processes.

High Maintenance Costs: Over time, legacy core banking platforms accrue substantial maintenance expenses. Continuously supporting and modifying these systems strains a bank’s financial resources.

Limited Flexibility: Legacy systems exhibit inflexibility, making it arduous to adapt to evolving customer preferences and regulatory standards.

Scalability Constraints: Legacy systems may struggle to scale efficiently to accommodate growing transaction volumes. This limitation impedes a bank’s expansion efforts and its ability to cater to a larger clientele.

Get free Consultation and let us know your project idea to turn into an amazing digital product.

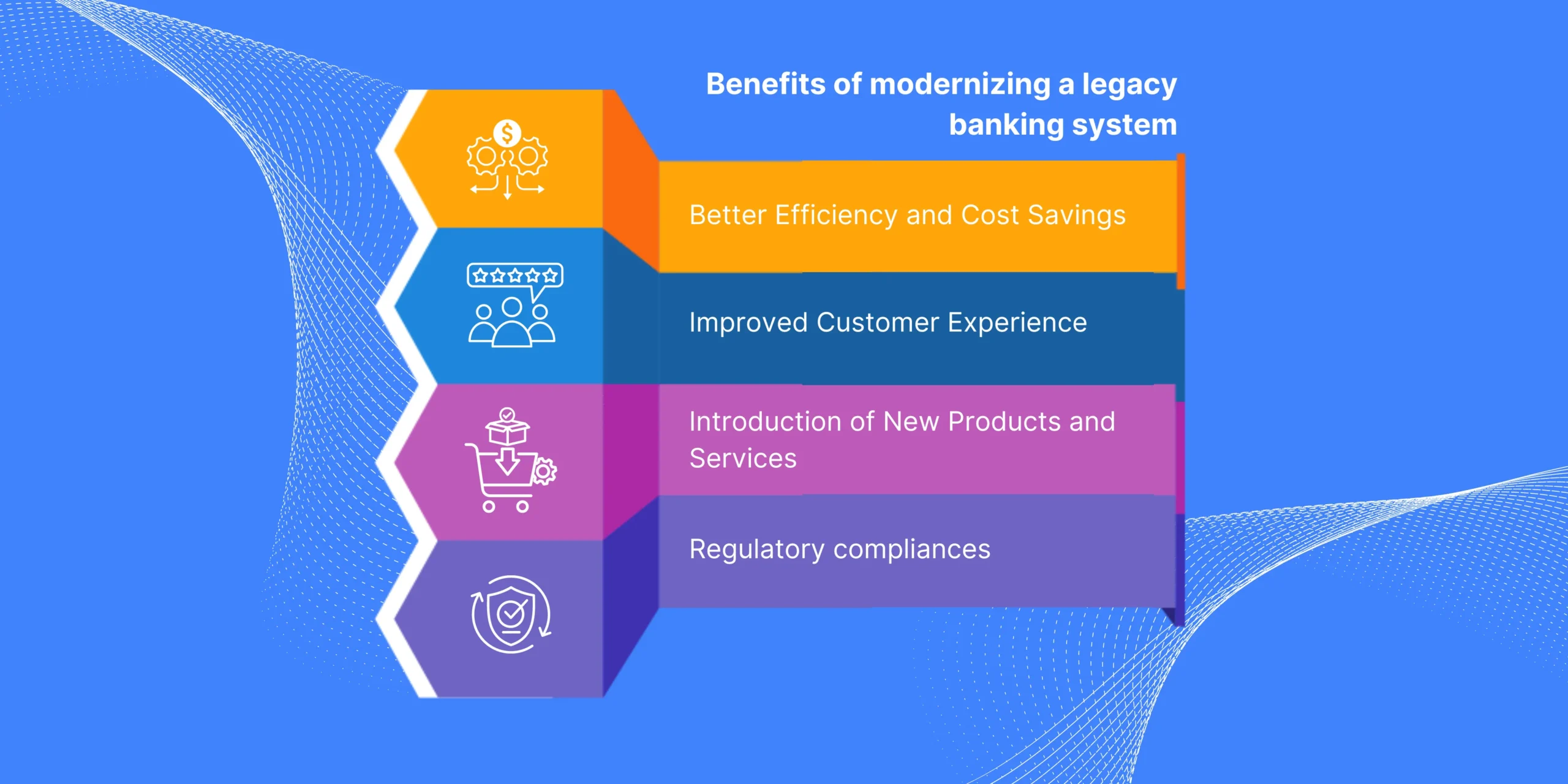

By updating old systems, banks can make operations smoother, automate tasks, and reduce the need for manual work, which saves money. New systems use advanced technology to process transactions faster, making banking quicker and more efficient.

Modernizing old systems also means making things better for customers. New systems are easier to use, navigate, and access. Customers can now bank from anywhere, using any device, which makes banking more convenient.

Updating allows banks to bring in new things like mobile banking, digital wallets, and other advanced financial stuff. These new features make banking more enjoyable for customers and help the bank stay competitive.

Updating old systems ensures the bank follows all the rules and laws, which is equally significant in banking. New systems are better at meeting the latest rules, helping the bank avoid trouble and keep customers satisfied.

Banks are moving away from old legacy banking systems because they’re outdated and inflexible. These systems make it hard for banks to keep up with changes in the market and meet customers’ needs. They’re also expensive to maintain and can be risky because they’re not updated with the latest security features. Switching to modern systems like Azure helps banks become more flexible, efficient, and secure, so they can stay competitive in the banking industry.

As banks move towards migrating their old banking systems, Azure emerges as the top choice for several strong reasons. Let’s explore why Azure is increasingly becoming the preferred solution for banking data migration:

Azure offers a wide range of tools and services including advanced analytics, AI capabilities, and robust database management systems. These features empower banks to move their data effortlessly while improving their processing and analytical capabilities, leading to better decision-making and improved customer services.

Security and compliance are top priorities in the banking industry, and Azure delivers with state-of-the-art security features and adherence to international and industry-specific compliance standards. This ensures that banks can move their data with confidence, knowing that it remains protected and compliant with regulations.

Azure’s cloud infrastructure is built to be highly available, scalable, and reliable, allowing banks to easily adjust their operations based on their needs without investing in physical infrastructure. This flexibility is crucial for handling varying volumes of banking transactions and data.

Azure excels in its ability to work with existing banking systems and third-party applications, ensuring a smooth transition during data migration with minimal disruption to existing workflows and services.

Azure constantly evolves, offering innovative tools and services that keep banks at the forefront of technology. From Azure Virtual Network Service Endpoint to Azure Data Factory and Azure Databricks, Azure provides a comprehensive suite of solutions for data migration and management, enabling banks to unlock the full potential of their data.

Elimination of Downtime: Moving legacy systems to Azure allows banks to avoid disruptive downtimes during system upgrades, ensuring a smooth transition and minimal service interruptions for customers.

By using Azure services, banks can optimize their IT infrastructure and significantly reduce costs, making it a cost-effective solution for data migration.

Azure provides scalability to handle peak transaction loads, ensuring optimal performance even during high-demand periods.

Azure offers robust security features, including encryption, access controls, and threat detection, ensuring the protection of sensitive customer data and safeguarding the bank’s reputation.

Azure’s agility enables banks to respond effectively to changing market conditions, whether it’s launching new services or adapting to regulatory changes.

Azure supports the strangler pattern approach, allowing banks to gradually replace parts of the legacy system without disrupting the entire system.

Azure Kubernetes Service (AKS) supports microservices and containers, enabling banks to gradually replace legacy functionality with new components in an isolated environment.

Azure SQL Database provides a robust data platform for modernization, allowing banks to leverage Big Data analytics for real-time insights.

Azure’s array of cutting-edge tools and services ensures that banks remain at the forefront of technological advancement. When it comes to managing data, Azure provides:

Azure Virtual Network (VNet) Service Endpoint: Boosts security by creating a network infrastructure within Azure, allowing secure, direct connections to Azure-defined VNets, and ensuring access to vital Azure resources.

Database Migration Techniques: Methods like Lift and Shift, Azure Database Migration Service, and Bulk Copy Program (BCP) make shifting on-premises databases to Azure SQL Database seamless.

Blob Storage, File Storage, and Azure Data Box offer scalable and cost-effective options for storing and handling various data types.

With Azure Information Protection (AIP), users gain tools for organizing, labeling, and safeguarding sensitive documents and emails, ensuring compliance and data security.

For managing data movement and monitoring, Azure Data Factory provides a comprehensive service that simplifies data transformation and integrates seamlessly with other Azure services.

Powered by Apache Spark, Azure Databricks is a high-performance analytics platform that facilitates collaborative work for data transformation and machine learning tasks.

Data Archiving and Compliance Solutions: Solutions like Azure Archive Storage and Azure SQL Database Long-Term Retention provide secure and compliant long-term storage options for infrequently accessed data.

Data Management and Deletion Strategies: Implementation of strategies for routine data deletion and utilizing Azure Functions for automating deletion tasks, thus reducing data storage costs.

Azure’s Integrated Services for Operational Efficiency: Tools like Azure Functions and Azure Storage Client Tools streamline data store management, enhancing operational efficiency through automation.

Innovative Data Solutions Beyond Traditional SQL: Azure offers a variety of solutions tailored to different data types and structures, accommodating third-party databases and providing flexible storage and processing options.

In summary, the imperative to modernize antiquated networks within the banking sector cannot be overstated. It is paramount for banks to maintain their competitive edge, drive innovation, and uphold compliance standards in an ever-evolving landscape. Despite the inherent challenges and financial commitments associated with such endeavors, the rewards of modernization, including streamlined operations, elevated customer experiences, and the facilitation of novel product and service offerings, far outweigh the risks of perpetuating outdated systems. By adhering to industry best practices and leveraging sophisticated tools like the Azure Database Migration Service, banks can seamlessly transition from legacy infrastructure to state-of-the-art systems, ensuring their sustained relevance and leadership in the digital era.

Our Articles are a precise collection of research and work done throughout our projects as well as our expert Foresight for the upcoming Changes in the IT Industry. We are a premier software and mobile application development firm, catering specifically to small and medium-sized businesses (SMBs). As a Microsoft Certified company, we offer a suite of services encompassing Software and Mobile Application Development, Microsoft Azure, Dynamics 365 CRM, and Microsoft PowerAutomate. Our team, comprising 90 skilled professionals, is dedicated to driving digital and app innovation, ensuring our clients receive top-tier, tailor-made solutions that align with their unique business needs.

In this blog, we’ll explore how AI-driven automation is reshaping banking. From boosting operational efficiency to improving compliance and risk management, we’ll look at how this technology is creating smarter, more adaptive financial systems.

Traditional fraud detection methods often fall short in detecting today’s fraud intelligence. They rely on pre-set rules and struggle a lot. This is where the role of machine learning steps in. Using AI-powered fraud detection in banking is a smart way to deal with cyber threats.

The combination of Microsoft AI, Azure Health Insights, and Azure Cognitive Services is transforming healthcare by allowing smarter and efficient decision-making based on data. These technologies can fundamentally change the conventional practices of healthcare by taking new approaches to enhance

Azure Database Migration Service is a tool provided by Azure that facilitates seamless migration of on-premises databases to Azure SQL Database. It is part of the broader suite of Azure Database Services aimed at simplifying database management and migration tasks for businesses.

Yes, Azure provides robust data platforms like Azure SQL Database, which allows banks to leverage Big Data analytics for real-time insights and informed decision-making.

The strangler pattern approach allows banks to gradually replace parts of the legacy system without disrupting the entire system, ensuring a seamless migration process.

Founder and CEO

Chief Sales Officer